Terms and Conditions - Malaysia

NOTICE TO CUSTOMERS

Customer Due Diligence (CDD) is a requirement under the Anti-Money Laundering and Anti-Terrorism Financing Act 2001 (AMLATFA) and Money Services Business Act 2011 (MSBA). CDD shall be conducted on customers conducting any transaction. Please produce your identification document before making any transaction.

Pelaksanaan Usaha Wajar Pelanggan (Customer Due Diligence / CDD) adalah satu keperluan di bawah Akta Pencegahan Pengubahan Wang Haram dan Pencegahan Pembiayaa Keganasan 2001 (ALMATFA) dan Akta Perniagaan Perkhidmatan Wang 2011 (MSBA). Usaha Wajar Pelanggan akan dilaksanakan terhadap pelanggan yang melakukan sebarang transaksi. Sila sediakan dokumen pengenalan anda sebelum menjalankan sebarang transaksi.

TERMS & CONDITIONS

1. CONTRACT FORMATION AND OVERVIEW

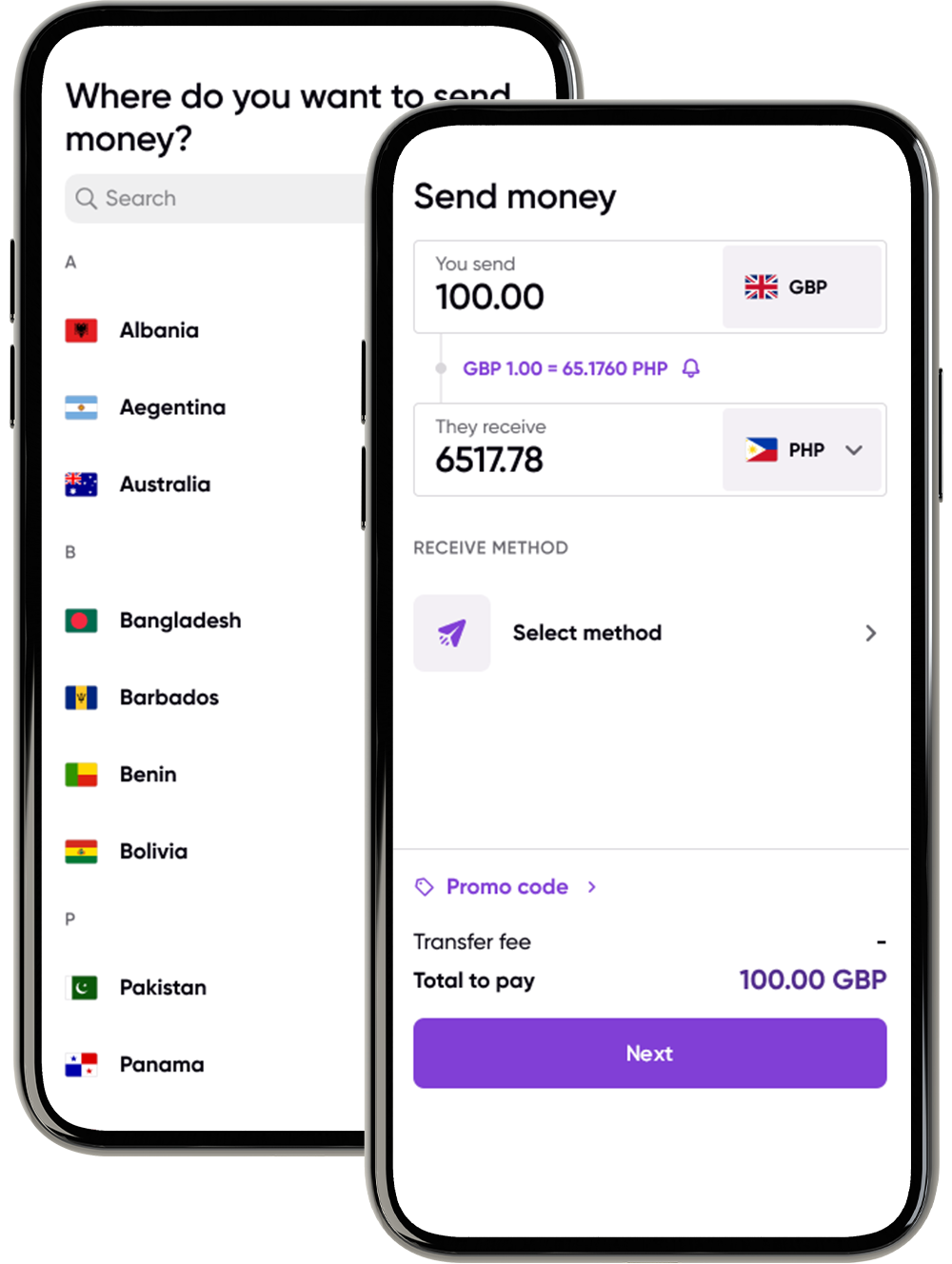

1.1 These terms and conditions ("Terms and Conditions") govern the terms under which you may access and use the website (and for the purpose of these Terms and Conditions “website” will include our App (where applicable) and the services associated with it (together, the "Service"). By accessing, registering with and using the Service, you agree to be bound by the terms of the Terms and Conditions. If you do not wish to be bound by the Terms and Conditions do not access, register with or use the Service. The language of these Terms and Conditions is English and all Services, instructions and transactions carried out in connection with it shall be in English.

1.2 In these Terms and Conditions, the terms "WorldRemit", "we", "us", and "our" refer to WorldRemit (Malaysia) SDN.BHD., together with its employees, directors, affiliates, successors, and assigns. WorldRemit (Malaysia) SDN. BHD. is a company registered in Malaysia with company registration number 201701022958 (1237124-V) with its registered office at Suite 2.6, Block L Avenue Business Centre, Plaza Damas, No. 60 Jalan Sri Hartamas 1, 50480 Sri Hartamas, Kuala Lumpur and licensed by the Central Bank as a money transfer service, license number 00300. To verify, please visit www. bnm.gov.my.

1.3 The terms "you" and "your" refer to users of the Service, as Senders, Recipients, other users or visitors to the website.

1.4 These Terms and Conditions are effective from the date on which you first access, register or use the Service. The Terms and Conditions may change from time to time, but changes will only be effective 2 months from the date they are first notified to you and will not change the terms on which you previously used the Service.

1.5 The Service was created: (a) to assist customers to send money to their family and friends, and to receive money from family and friends, around the world; and (b) to offer customers the ability to credit a mobile phone account with Airtime Top Up. For security reasons, we recommend that you only send money or Airtime Top Up through the Service to people you know personally. You must not use the Service to send money or Airtime Top Up to strangers, for example sellers of goods and/or services, whether private or retail.

2. DEFINITIONS

In these Terms and Conditions:

“App” means WorldRemit’s mobile application for the sending of Payment Requests and/or Transaction Requests.

“Airtime Top Up” means credit, which is added to a mobile phone account, which can be used to make calls, send text or picture messages and use data, that is purchased by the Sender and credited to the Payee’s mobile phone account typically within a few seconds.

“Business Day” means any day on which we are open for business for the execution of Transaction Requests and/or Payment Requests.

"Destination Country" means the country in which the Payee receives money or Airtime Top Up through the Service.

“Instruction” means a Payment Request and/or a Transaction Request.

"Local Taxes" means any taxes or charges payable in the Destination Country.

“Payee” means someone who receives money or Airtime Top Up through the Service.

"Payment Instrument" means a valid instrument of payment such as a bank account or debit card.

“Payment Request” means a specific instruction from you to a Sender requesting a Transaction.

"Payout Amount" means the amount paid out, after any foreign exchange conversion, to the Payee’s account exclusive of the Service Fee.

"Recipient" means:

(a) a Payee; or

(b) in the event that you are using the Service to send a Payment Request, someone who receives the Payment Request.

"Sender" means someone who uses the Service to send money or Airtime Top Up.

"Service Fee" means WorldRemit’s fee plus any additional charges or Local Taxes applicable to each Transaction, which WorldRemit may charge in its sole discretion in accordance with applicable laws, as may be described on the WorldRemit website from time to time.

"Service Provider" means a local bank, money exchange house, or other third party service providers (e.g. mobile network operators) in the Destination Country with whom WorldRemit works to provide the Service.

"Transaction" means the transfer of money or Airtime Top Up through the Service.

“Transaction Amount" means the amount of money or the value of the Airtime Top Up that the Sender wishes to send to the Payee as a Transaction, excluding any applicable Service Fee and prior to any foreign exchange conversion.

“Transaction History” means the record of your Transactions on our website which you may access using your email and password registration details.

"Transaction Request" means a specific instruction from you requesting us to send money or AirTime Top Up to a Payee through the Service.

3. OUR OBLIGATIONS

3.1 Subject to these Terms and Conditions, we agree to provide the Service to you using reasonable care. You acknowledge that the Service may not be available, in whole or in part, in certain regions, countries, or jurisdictions.

3.2 We are not obliged to process any particular Transaction. When you submit a Transaction Request, you are requesting that we process the Transaction on your behalf and consenting to the execution of the Transaction. We may, in our sole discretion, choose whether or not to accept the offer to process that Transaction. If we decide not to process the Transaction, we will notify you promptly of that decision and repay to you the Transaction Amount received by us, provided that we are not prohibited by law from doing so. If we choose to proceed with the Transaction we may still suspend or cancel it in our discretion.

3.3 WorldRemit reserves the right to modify or discontinue the Service or any part of the Service without notice, at any time and from time to time.

3.4 We may, in our absolute discretion, refuse any Transaction Request (as further detailed in clause 5) or impose limits on the Transaction Amount. We may do so either on a per Transaction basis or on an aggregate basis, and either in respect of one set of registration details or one Payment Instrument or on related sets of registration details or Payment Instruments.

3.5 Delivery times quoted on our service levels or elsewhere on our website are representative for the “normal” / average service and are not a guarantee of an individual Service or Transaction time.

3.6 We will attempt to process Transactions promptly, but any Transaction may be delayed or cancelled for a number of reasons including but not limited to: our efforts to verify your identity; to validate your Transaction instructions; to contact you; or due to variations in business hours and currency availability; or otherwise to comply with applicable law.

3.7 We may send and receive notifications in relation to Transactions by email and SMS. We will provide you with information after receipt of a Transaction Request enabling you to identify the Transaction, along with details of the amount of the Transaction in the currency used in the Transaction Request, our Service Fee, exchange rate and the date on which the Transaction Request was received.

3.8 We will attempt to provide Senders and Recipients with up to date information regarding the location and opening hours of our Service Providers by means of information on our website. However, you agree that WorldRemit shall not be held responsible for any inaccuracies that may appear in that information or any consequential loss which may result from incorrect or incomplete information.

4. YOUR OBLIGATIONS

4.1 You agree that:

4.1.1 you will not access, use or attempt to use the Service to provide any Instructions unless you are at least 18 years old, and that you have the legal capacity to form a binding legal contract in any relevant jurisdiction;

4.1.2 for each Transaction Request that you submit, you will pay us the Service Fee in addition to the Transaction Amount. Payment becomes due at the time that you submit your Transaction Request. To the maximum extent permitted by law, the Service Fee is non-refundable unless expressly stated in these Terms and Conditions. If you submit a Transaction Request that results in WorldRemit becoming liable for charges including but not limited to chargeback or other fees, you agree to reimburse us for all such fees;

4.1.3 you will not use any device, software or routine to interfere or attempt to interfere with the proper working of the Service or any Instruction being conducted through the Service;

4.1.4 in connection with your registration and use of the Service, you will:

(a) provide us with true, accurate, current and complete evidence of your identity, and promptly update your personal information if and when it changes;

(b) provide us with any identity documentations as may be requested by us;

(c) provide us with details of one or more Payment Instruments;

(d) provide us with true, accurate, current and complete information as we indicate on the website is required to receive the Service and any other information which may be required in relation to the Recipient;

(e) provide us with:

(i) any other information that must be provided for a Transaction Request to be properly executed, as specified when you enter the details of the Transaction you are interested in on our website; and

(ii) such information relating to the Transaction as detailed in clause 5.4.

4.2 We do not accept any liability for loss or damages to you or any third party resulting from non-payment or delay in payment of a Payout Amount to a Payee or failure to perform an Instruction under the Service if you are in breach of your obligations listed in clause 4.1.

4.3 When you are using the Service under these Terms and Conditions, it is your responsibility to make sure all the details are accurate before submission. Once a Transaction Request has been received it is not normally possible to change any details of that Transaction Request. You will be given the opportunity to confirm Transaction Requests before submission and you must check the details carefully.

4.4 The total amount (the Transaction Amount, Service Fee and other applicable fees and charges) that you will be required to pay and the relevant exchange rate will be displayed clearly on the website before you are asked to confirm your Transaction and proceeding with the Transaction at this point is entirely optional.

4.5 When you pay a Transaction Amount in one currency and the Payout Amount is in another currency, there will be a difference between the exchange rate at which we buy foreign currency and the exchange rate provided to you. WorldRemit and its Service Providers usually make a small profit in these circumstances. We guarantee you the Payout Amount in local currency. The margin taken on foreign currency exchange covers our risk in guaranteeing this. If a Payee’s account is denominated in a currency other than the currency you instructed us to make payment in there may be delays, additional charges or different exchange rates. The Sender is therefore responsible for ensuring that the currency requested for the Transaction matches the currency of the account where the funds are to be delivered.

4.6 WorldRemit will have no responsibility for any fees or charges you may incur by the use of a particular Payment Instrument to fund a Transaction. These may include but are not limited to unauthorised overdraft fees imposed by banks if there are insufficient funds in your bank account or "cash advance" fees and additional interest which may be imposed by credit card providers if they treat use of the Service as a cash transaction rather than a purchase transaction.

4.7 You will only use the Service to send money to people that you know personally and not to pay for goods or services from third parties you do not know and trust. You acknowledge that WorldRemit may refuse to process your Transaction Request where we believe you are using the Service to purchase goods or services from third parties you do not know and trust or where we believe that the Service is being used, by you or the Recipient, in furtherance of fraudulent, illegal or unethical activities. If you choose to pay third parties for goods and services using the Service, you acknowledge that WorldRemit has no control over, and is not responsible for, the quality, safety, legality, or delivery of such goods or services and that any such use of the Service is entirely at your own risk.

4.8 Both you and the Recipient will only act on your own behalf. You may not submit an Instruction or receive a Transaction on behalf of a third person. If you intend to submit an Instruction or receive a Transaction on behalf of a third person, you must first inform WorldRemit of your desire to do so and provide us with any additional information about the third person we may request in order that we may decide whether to permit the Instruction or Transaction.

4.9 In using the Service you will comply with these Terms and Conditions as well as any applicable laws, rules or regulations. It is a breach of these Terms and Conditions to use the Service to send Transaction Amounts: (i) to a Payee who has violated the Terms and Conditions, or (ii) in connection with illegal activity including but not limited to money-laundering, fraud and the funding of terrorist organisations. If WorldRemit reasonably believes you are using the Service in connection with illegal activity or for any fraudulent purpose, or are permitting a third party to do so, WorldRemit may report you to the appropriate legal authorities.

4.10 When using our website or the Service or when interacting with WorldRemit, with another user or with a third party, you will not:

4.10.1 breach these Terms and Conditions, or any other agreement between you and WorldRemit;

4.10.2 create more than one registration without our prior written permission;

4.10.3 provide false, inaccurate, or misleading information;

4.10.4 allow anyone else access to your registration details, and you will keep those details safe and secure;

4.10.5 refuse to provide confirmation of any information you provide to us, including proof of identity, or refuse to co-operate in any investigation;

4.10.6 use an anonymising proxy (a tool that attempts to make activity untraceable); or

4.10.7 copy or monitor our website using any robot, spider, or other automatic device or manual process, without our prior written permission.

4.11 You acknowledge that nothing in these Terms and Conditions or in any other information provided by WorldRemit as part of the Service is intended to be, nor should it be construed to be, legal or other advice. If required, you agree to consult your own professional advisers as to the effects of Malaysian or foreign laws which may apply to the Service.

5. OUR RIGHT TO REFUSE, SUSPEND OR CANCEL

5.1 We may refuse any Transaction Request, Payment Request or Transaction at any time for any reason (or cancel it where relevant).Notwithstanding this, we set out here some examples of when that may occur.

5.1.1 We may, in our absolute discretion, refuse or cancel Transaction Requests or Transactions where we believe that the Service is being used, whether by you or the Recipient, in furtherance of illegal, fraudulent or unethical activities.

5.1.2 We may, in our absolute discretion, refuse or cancel Transaction Requests or Transactions from certain Senders or to certain Payees, including but not limited to entities and individuals on restricted or prohibited lists issued from time to time by any government authorities, if we are required to do so by law, or where we have reason to believe processing the Transaction Requests would violate anti-money laundering or counter-terrorism financing laws and regulations. We may refuse to process a Transaction funded from certain Payment Instruments where we have reason to believe the security of the Payment Instrument has been compromised or where we suspect the unauthorised or fraudulent use of the Payment Instrument.

5.1.3 We may, in our absolute discretion, refuse or cancel Transaction Requests or Transactions if WorldRemit believes you are using the Service to purchase goods or services from third parties you do not know or trust.

5.1.4 We may, in our absolute discretion, refuse or cancel Transaction Requests, Payment Requests or Transactions if:

(a) WorldRemit is unable to verify your identity;

(b) WorldRemit is unable to verify the identity of the Recipient;

(c) You do not comply with information requests pursuant to clause 5.4; or

(d) WorldRemit reasonably believes you are using the Service, or allowing it to be used, in breach of these Terms and Conditions or any applicable laws, rules or regulations.

5.2 Where WorldRemit has refused or cancelled a Transaction Request, Transaction or Payment Request, WorldRemit may also, at its discretion, temporarily or permanently suspend your Registration

5.3 Where WorldRemit temporarily or permanently suspends your Registration, or refuses or cancels a Transaction Request, Payment Requestor a Transaction in accordance with this clause 5, WorldRemit shall be entitled to retain any Service Fees already incurred.

5.4 In order to comply with our obligations under relevant laws, we reserve the right to ask for further information or evidence relating to the purpose of a Transaction.

6. YOUR RIGHT TO CANCEL; REFUNDS

6.1 To the extent permitted by law, once we have received your Instruction, you do not have the automatic right to revoke it.

6.2 Notwithstanding clause 6.1 above, WorldRemit may, in its absolute discretion, attempt to cancel your Instruction if you have informed us that you wish to revoke it. In some cases, WorldRemit may have initiated an irreversible request for funds to be paid out to your Payee by a Service Provider and therefore cannot guarantee cancellation will be successful. For successful revocations WorldRemit will normally refund your money, less any reasonable revocation charges and any Service Fees already charged.

6.3 If you:

6.3.1 have any problems using the Service; or

6.3.2 are aware of any unauthorised or incorrectly executed Transactions;

you should contact us through the channels listed at the end of these Terms and Conditions without delay and in any event no later than 13 months after the date the Transaction Amount was debited, upon becoming aware of the unauthorised or incorrectly executed Transaction. A request for a refund must be submitted in writing (including by email) to one of the contact points listed at the bottom of these Terms and Conditions, giving the Sender's full name, address, and phone number, together with the Transaction tracking number, Transaction Amount, and the reason for your refund request.

6.4 If we have executed the Transaction in accordance with the instructions you have provided to us, and that information proves to have been incorrect, we are not liable for the incorrect execution of the Transaction. We will however make reasonable efforts to recover the funds. We may charge you a reasonable fee, reflective of our efforts, to do so.

6.5 Where WorldRemit has executed the Transaction otherwise than in accordance with your Instruction, subject to clause 11.2, WorldRemit will refund the full amount debited. Unless there are exceptional circumstances, no adjustment will be made for any currency fluctuations which may have occurred between the time you pay us the Transaction Amount and the time of credit.

6.6 Any refunds will be credited back to the same Payment Instrument used to fund the Transaction and in the same currency.

7. AIRTIME TOP UP

7.1 To send Airtime Top Up, you agree to comply with and undertake the provisions set out in these Terms and Conditions and this clause 7.

7.2 The Airtime Top Up service shall only be provided to you by us in respect of the mobile phone operators available on the website, which are subject to change and availability.

7.3 You will be required to input the mobile phone number to which any Airtime Top Up is to be credited into the appropriate space on the website. It is your responsibility to ensure that you have correctly inputted the mobile phone number. You will then be required to select the amount of Airtime Top-Up that you wish to credit that mobile phone number with.

7.4 When sending an Airtime Top Up, you will be asked to enter the Payee’s phone number twice. This is a unique identifier required to ensure that Airtime Top Up is not sent to the wrong person because of a mis-typed number. However, if you enter the wrong number twice, the transfer will go ahead and there is no way to reclaim or redirect the Airtime Top Up once the Transaction Request has been processed by us.

7.5 You are responsible for checking carefully with the Payee that you have their correct phone number.

7.6 The cost of Airtime Top Up will vary depending on the amount of Airtime Top Up that you wish to send to your friend or family member and according to the denominations displayed on the website.

7.7 The total amount (the Transaction Amount and our Service Fee) that you will be required to pay will be displayed clearly on the website before you are asked to confirm your Transaction and proceeding with the Transaction at this point is entirely optional.

7.8 A number of countries around the world have chosen to apply taxes to incoming Airtime Top Ups. When sending to a Payee in these countries, the corresponding deduction will be made from the Transaction Amount, meaning the Payee will get a lower amount of Airtime Top Up.

7.9 If the Payee you are sending to is in a country which does deduct taxes from Airtime Top Ups, you will see information about the rate on the WorldRemit service or App before completing the transfer.

7.10 The Airtime Top Up is typically sent within a few seconds by us to the mobile phone number you provide upon successful payment by you. Occasionally, there may be a short delay before the relevant mobile operator applies the Airtime Top Up to the mobile phone number e.g. due to congestion on the local mobile network. If you have questions about a longer delay, please contact our Customer Service Team here.

7.11 You agree and understand that we only act on your authorisation to send Airtime Top Up and the relevant mobile operator shall be solely liable to you and the Payee of the Airtime Top Up for the provision of mobile services related to the Airtime Top Up. Once the Airtime Top Up is sent to a mobile phone number, it cannot be refunded or removed from the phone. To stop this mistake from happening, we ask you to ensure that the number you have entered is correct.

7.12 You acknowledge that you will lose the right to cancel the Airtime Top Up once the Airtime Top Up service has been fully performed by us. Accordingly, you will have no right to request a refund under Malaysia’s Consumer Protection Act 1999.

7.13 Please note that the website limits the number of Airtime Top Ups that can be performed or the maximum value of Airtime Top Ups sent over a specific time period (e.g. daily, weekly, monthly).

7.14 Other limits and exclusions related to Airtime Top Ups or the use of the website may be applicable. You will be notified through the website or by email of these additional limitations should they exist or come into existence.

8. PAYMENT REQUEST

8.1 You agree that you will not send Payment Requests to strangers i.e. people you do not know personally.

8.2 You acknowledge that the Service may not be available, in whole or in part, in certain regions, countries, or jurisdictions.

8.3 We are not obliged to process any particular Payment Request. When you submit a Payment Request, you are requesting that we process the Payment Request on your behalf and consenting to us contacting the Sender for these purposes. You acknowledge and agree that, when we send a Payment Request by SMS text message to a Sender on your behalf, we may use the mobile telephone number associated with your account for this purpose (i.e. the Payment Request we send will show as being sent from your mobile telephone number). We may, in our sole discretion, choose whether or not to process that Payment Request, or impose limits on Payment Requests. In particular, we may, in our absolute discretion, refuse Payment Requests and/or suspend or cancel your account with us where (i) you are in breach of clause 4, (ii) we believe that the Service is being used, whether by you or the Sender, in furtherance of illegal, fraudulent or unethical activities, or (iii) we are required to do so by law (including applicable anti-money laundering and counter-terrorism legislation) or (iv) we are unable to verify either your identity or that of the Sender.

8.4 All Transactions that result from a Payment Request will be handled in accordance with these Terms and Conditions, which the Sender will need to accept prior to any Transaction proceeding.

8.5 Cancellation of Payment Requests. Once we have received your Payment Request, you may not cancel it. In such circumstances you would need to contact the Sender separately, and explain that you require the Payment Request to be treated as cancelled. Please therefore ensure that your Payment Requests are legitimate, accurate and complete.

8.6 Cancellation of Transactions. The cancellation of Transactions shall be governed by, and dealt in accordance with these Terms and Conditions. You shall assist and co-operate with us in relation to all cancellation requests we receive from Senders after a Transaction has been initiated following your Payment Request. You shall, upon request from us, promptly refund to us or a third party of our choice (including the Sender) all monies you receive from Transactions where we reasonably believe that such Transactions have resulted from your use of the Services in contravention of these Terms and Conditions.

9. COLLECTION OF INFORMATION

9.1 Customer Identification Program. Malaysian law requires all financial institutions to assist in the fight against money laundering activities and the funding of terrorism by obtaining, verifying, and recording identifying information about all customers. We may therefore require you to supply us with personal identifying information relating to you and the Recipient and we may also legally consult other sources to obtain information about you and the Recipient.

9.2 Verification and Checks. We will verify your residential address and personal details in order to confirm your identity. We may also pass your personal information to a credit reference agency, which may keep a record of that information. Be assured that this is done only to confirm your identity, and that we do not perform credit checks and therefore your credit rating will be unaffected. We may also need to verify the identity of a Recipient in the same way. All information provided by you will be treated securely and strictly in accordance with the requirements and guidelines of the Personal Data Protection Act 2010 (PDPA). By accepting these Terms and Conditions you authorise us to make any inquiries we consider necessary to validate the information that you provide to us. We may do this directly, for example by asking you for additional information, or requiring you to take steps to confirm ownership of your Payment Instruments or email address; or indirectly, for example by verifying your information against third party databases or through other sources.

9.3 Data Privacy Policy. You consent to our processing your personal information for the purposes of providing the Service, including for verification purposes as set out in this clause. You also consent to the use of such data to enable us and our authorised third parties to communicate with you, and for statutory, accounting and archival purposes, in accordance with the terms of WorldRemit's Privacy Policy. You acknowledge that you have read and consented to WorldRemit's Privacy Policy. The Privacy Policy can be found by clicking here.

9.4 Government Disclosures. We may be required by law to provide information about you, your use of the Service and your Instructions to government or other competent authorities as described in our Data Privacy Policy. You acknowledge and consent to us doing this.

9.5 WorldRemit may, as necessary in providing the Service, store all information required of a Recipient to prove his or her identity or associated with their specific Instruction. Such proofs may include a suitable form of valid, unexpired identification from a list of acceptable papers provided by the Service Provider, and/or a transaction tracking number, a personal identification number (PIN), a "password", a "secret word", or other similar identifiers.

10. INTELLECTUAL PROPERTY

10.1 The WorldRemit website and the WorldRemit Service, the content, and all intellectual property relating to them and contained in them (including but not limited to copyrights, patents, database rights, trademarks and service marks) are owned by us, our affiliates, or third parties. All right, title and interest in and to the WorldRemit website and the Service shall remain our property and/or the property of such other third parties.

10.2 The WorldRemit website and the WorldRemit Service may be used only for the purposes permitted by these Terms and Conditions or described on the website. You are authorised solely to view and to retain a copy of the pages of the WorldRemit website for your own personal use. You may not duplicate, publish, modify, create derivative works from, participate in the transfer or sale of, post on the internet, or in any way distribute or exploit the WorldRemit website, the WorldRemit Service or any portion thereof for any public or commercial use without our express written permission. You may not: (a) use any robot, spider, scraper or other automated device to access the WorldRemit website or the WorldRemit Service; and/or (b) remove or alter any copyright, trademark or other proprietary notice or legend displayed on the WorldRemit website (or printed pages of the website). The name “WorldRemit” and other names and indicia of ownership of WorldRemit's products and/or services referred to on the WorldRemit website are our exclusive marks or the exclusive marks of other third parties. Other products, services and company names appearing on the website may be trademarks of their respective owners, and therefore you should not use, copy or reproduce them in any way.

11. WARRANTIES AND LIABILITY

11.1 Where we have materially breached these Terms and Conditions causing a Sender loss, we will refund the Sender the Transaction Amount and the Service Fee.

11.2 If a Transaction is delayed or fails, or if an executed Transaction is not authorised, you may have a right to receive a refund or compensation under laws relating to the provision of international money transfer services. In the case of any unauthorised or incorrectly executed Transaction, any such right may be prejudiced if you do not notify us of the unauthorised or incorrectly executed Transaction without delay, or in any event within thirteen months after the debit date. We will provide you with the further details of your rights to a refund or compensation if you contact us using the contact details at the end of these Terms and Conditions.

11.3 Any claim for compensation made by you must be supported by any available relevant documentation.

11.4 If any loss that you suffer is not covered by a right to payment under the laws referred to in clause 11.2, we will only accept liability for that loss up to a limit which is the greater of: (a) the amount of any Service Fee and (b) RM500, unless otherwise agreed by us in writing. The cap on our liability only limits a claim for loss arising out of any single Transaction or series of related Transactions, or (if a loss does not arise out of a Transaction or related Transactions) any single act, omission or event or related acts, omissions or events. This means that if, for example, you suffer loss by reason of our failure to perform our agreement with you under two unrelated Transactions, you might be able to claim up to RM1,000.

11.5 We do not, in any event, accept responsibility for:

11.5.1 any failure to perform the Service (e.g. your Instruction) as a result of circumstances which could reasonably be considered to be due to abnormal and unforeseen circumstances or outside our control or due to our obligations under any applicable laws, rules or regulations;

11.5.2 malfunctions in communications facilities which cannot reasonably be considered to be under our control and that may affect the accuracy or timeliness of messages you send to us;

11.5.3 any losses or delays in transmission of messages arising out of the use of any internet or telecommunications service provider or caused by any browser or other software which is not under our control; or

11.5.4 errors on the website or with the Service caused by incomplete or incorrect information provided to us by you or a third party.

11.6 Nothing in this clause 11 shall (a) exclude or limit liability on our part for death or personal injury resulting from our negligence; or (b) exclude our liability for fraud.

11.7 Where you are sending a Transaction Amount to a Payee who is not registered with us, you agree to accept the provisions of this clause 11 not only for yourself, but also on behalf of the Payee.

11.8 Your relationship is with WorldRemit only. You agree that no affiliate or agent of WorldRemit owes you any duty of care when performing a task which would otherwise have to be performed by WorldRemit under its agreement with you.

11.9 You understand and acknowledge that you are liable for all losses incurred in respect of an unauthorised Transaction or Instruction or any other unauthorised use of the Service, where you have acted fraudulently or negligently and you agree to be responsible for and hold harmless WorldRemit, our subsidiaries, affiliates, officers, directors, employees, agents, independent contractors, advertisers, partners, and co-branders from all loss, damage, claims, actions or demands, including reasonable legal fees, arising out of your use or misuse of the website or Service, all activities that occur under your password or account e- mail login, your violation of these Terms and Conditions or any other violation of the rights of another person or party.

12. USE OF THE APP

12.1 In consideration of you agreeing to abide by these Terms and Conditions, we grant you a non-transferable, non-exclusive licence to use the App, subject to these Terms and Conditions, our Privacy Policy and the applicable app-store terms (incorporated into these Terms and Conditions by reference) as may be amended from time to time. We reserve all other rights.

12.2 Except as expressly set out in these Terms and Conditions or as permitted by any local law, you agree:

12.2.1 not to copy the App (except where such copying is incidental to normal use of the App, or where it is necessary for the purpose of back-up or operational security); and

12.2.2 not to rent, lease, sub-license, loan, alter, translate, merge, adapt, vary or modify the App.

12.3 You acknowledge that the App has not been developed to meet your individual requirements, and that it is therefore your responsibility to ensure that the facilities and functions of the App meet your requirements.

12.4 We only supply the App for domestic and private use. You agree not to use the App for any commercial, business or resale purposes, and we have no liability to you for any loss of profit, loss of business, business interruption, or loss of business opportunity. Specifically (but without limitation), we do not accept any liability for loss or damages to you or any third party resulting from any delay in us processing an Instruction or refusal by us to execute a Transaction pursuant to these Terms and Conditions.

12.5 The App is provided to you free of charge and as a result no representations, conditions, warranties or other terms of any kind are given in respect of the App, and all statutory warranties and conditions are excluded to the fullest extent possible under applicable law.

12.6 In relation to your use of the App, we do not, in any event, to the extent permitted by law, accept responsibility for:

12.6.1 any failure to perform the Services, or any losses or delays in the transmission of messages, due to circumstances outside our control or due to our obligations under any applicable laws, rules or regulations;

12.6.2 malfunctions in communications facilities which cannot reasonably be considered to be under our control and that may affect the accuracy or timeliness of messages we send to one another;

12.6.3 errors in the App or with the Service caused by incomplete or incorrect information provided to us by you or a third party; or

12.6.4 any loss or damage you suffered by you as a result of you using our App on a ‘jailbroken’, ‘rooted’ or otherwise modified device.

13. ELECTRONIC COMMUNICATIONS

13.1 You acknowledge that these Terms and Conditions shall be entered into electronically, and that the following categories of information ("Communications") may be provided by electronic means:

13.1.1 these Terms and Conditions and any amendments, modifications or supplements to it;

13.1.2 your records (e.g. of transactions) through the Service;

13.1.3 any initial, periodic or other disclosures or notices provided in connection with the Service, including without limitation those required by law;

13.1.4 any customer service communications, including without limitation communications with respect to claims of error or unauthorised use of the Service; and

13.1.5 any other communication related to the Service or WorldRemit.

13.2 The Service does not allow for Communications to be provided in paper format or through other non-electronic means. You may withdraw your consent to receive Communications electronically, but if you do, your use of the Service shall be terminated. In order to withdraw your consent, you must contact us using our contact information at the end of these Terms and Conditions.

13.3 In order to access and retain Communications, you must have or have access to the following:

13.3.1 an internet browser that supports256 – bit such as Internet Explorer version 8.0 or above;

13.3.2 an e-mail account, e-mail software capable of interfacing with WorldRemit's e-mail servers and the capability to read e-mail from WorldRemit, and a device and internet connection capable of supporting the foregoing; and

13.3.3 sufficient electronic storage capacity on your electronic device’s hard drive or other data storage unit; or

13.3.4 a printer that is capable of printing from your browser and e-mail software.

13.4 In addition, you must promptly update us with any change in your email address by updating your profile at http://www.worldremit.com.

14. TERMINATION

14.1 You may terminate these Terms and Conditions on one month’s written notice. We may terminate these Terms and Conditions upon two months’ notice, except as provided for in clause 14.2.

14.2 We may terminate these Terms and Conditions with immediate effect if you:

14.2.1 become, or we reasonably believe or become aware you are likely to become, insolvent or are declared bankrupt;

14.2.2 are in breach of any provision of these Terms and Conditions;

14.2.3 use the Service or the website in a way that is disruptive to our other customers, or you do anything which in our opinion is likely to bring us into disrepute;

14.2.4 breach or attempt to breach the security of the website (including but not limited to: modifying or attempting to modify any information; unauthorised log-ins, unauthorised data access or deletion; interfering with the service, system, host or network; reverse engineering of any kind; spamming; hacking; falsifying data; introducing viruses, Trojan horses, worms or other destructive or damaging programs or engines; or testing security in any way); or

14.2.5 are, in WorldRemit’s reasonable belief, using the Service in connection with fraudulent, illegal or unethical activity, or permitting a third party to do so.

15. COMPLAINTS

15.1 If you wish to make a complaint about any aspect of the WorldRemit service, please send your complaint in writing to the address shown on the Contact Us page of our website which can be found here.

15.2 We will acknowledge receipt of your complaint within 2 Business Days. We will investigate your complaint and come back to you with the results of our investigation no later than 7 Business Days after the receipt of our acknowledgement of your complaint.

16. GENERAL

16.1 Governing law: this Agreement will be governed by the laws of Malaysia and the parties shall submit to the exclusive jurisdiction of the courts of Malaysia.

16.2 No Waiver: The failure of WorldRemit to exercise or enforce any right or provision of the Terms and Conditions shall not constitute a waiver of such right or provision.

16.3 Modification: We may modify these Terms and Conditions from time to time without notice to you, except as may be required by law. You can review the most current version of the Terms and Conditions at any time by reviewing the website. You may terminate your use of the Service if you do not agree with any modification or amendment. If you use the Service after the effective date of an amendment or modification, you shall be deemed to have accepted that amendment or modification. You agree that you shall not modify these Terms and Conditions and acknowledge that any attempts by you to modify these Terms and Conditions shall be void.

16.4 Entire Agreement: This agreement constitutes the entire agreement between the parties and supersedes all prior understandings or agreements relating to the subject matter of this agreement.

16.5 Severability: If any provision of the Terms and Conditions is found by an arbitrator or court of competent jurisdiction to be invalid, the parties nevertheless agree that the arbitrator or court should endeavour to give appropriately valid effect to the intention of the Terms and Conditions as reflected in the provision, and the other provisions of the Terms and Conditions shall remain in full force and effect.

16.6 Any external links to third-party websites on the website are provided as a convenience to you. These sites are not controlled by us in any way and we are not responsible for the accuracy, completeness, legality or any other aspect of these other sites including any content provided on them. You access such websites at your own risk.

_________________________________

Security

We take security very seriously at WorldRemit and we work hard, using state-of-the-art security measures, to make sure that your information remains secure. The WorldRemit Service is a safe and convenient way to send money and/ or Airtime Top Up to friends and family and to other people that you trust.

However, we do advise you to consider very carefully before sending money to anyone that you do not know well. In particular, you should be very cautious of deals or offers that seem too good to be true - they may be scams. If you are aware of anyone or any entity that is using the Service inappropriately, please email us using our contact form. Similarly, if you receive any emails, purporting to be from WorldRemit, which you suspect may be "phishing" (fake) emails, please forward them to us using our contact form.

Contact Information

Questions, notices, and requests for refunds or further information should be sent to WorldRemit, as follows:

online at https://www.worldremit.com/en/contact-us;

by telephone at +60 1 800 818 717

or by post to:

WorldRemit, attn: Customer Service, WorldRemit (Malaysia) SDN. BHD. Suite 2.6, Block L, Avenue Business Centre, Plaza Damas, No. 60 Jalan Sri Hartamas 1, 50480 Sri Hartamas, Kuala Lumpur Malaysia.

1. CONTRACT FORMATION AND OVERVIEW

1.1 These terms and conditions ("Terms and Conditions") govern the terms under which you can use:

(a) our Money Transfer services;

(b) our Digital Money Account (including redeeming electronic money and paying the proceeds of redemption to yourself or another person); and/or

(c) Airtime Top Up.

1.2 These Terms and Conditions, together with our web page setting out the charges applicable for our services, form your agreement with us for a Digital Money Account and/or use of Airtime Top Up (the "Agreement").

1.3 By accessing, registering with and using any of these services, you agree to be bound by the terms of the Agreement.

1.4 The language of the Agreement is English, and all services, instructions and transactions carried out in connection with it will be in English.

1.5 You can obtain a copy of the Agreement at any time by asking us to send you a copy via email.

1.6 In the Agreement, the terms "WorldRemit", "we", "us", and "our" refer to WorldRemit Ltd, together with its employees, directors, successors, and assigns. WorldRemit Ltd is a company registered number 07110878 in England and Wales, with its registered office at 51 Eastcheap, London, EC3M 1DT, United Kingdom. WorldRemit Ltd is authorised and regulated by the Financial Conduct Authority under the Payment Services Regulations 2017 and Electronic Money Regulations 2011. Registration number: 900891. Its regulated activities include providing payment services and issuing electronic money.

1.7 The terms "you" and "your" refer to you, the person who has registered to use some or all of the services described in the Agreement.

1.8 This Agreement will be treated as coming into effect on the date you register with us and will continue for an indefinite period, until terminated by you or us.

2. DEFINITIONS

In these Terms and Conditions:

"Airtime Top Up" means the service which allows you to credit a mobile phone account with credit which can be used by the mobile phone account holder to make calls, send text or picture messages and use data. It is credited to the Payee’s mobile phone account typically within a few seconds.

“Business Day” means any day on which we are open for business for the execution of Payment Instructions and/or Payment Requests.

"Destination Country" means the country in which:

(a) (where you are the recipient) you receive either money or E-money from a Sender; or

(b) (where you are the person making payment or sending Airtime Top Up) another Payee receives money, E-money or Airtime Top Up as a result of you making a payment using either our Money Transfer service or E-money in your Digital Money Account.

“Digital Money Account” means a function in the Portal which stores E-money in a non-interest bearing account maintained by us for you, and which provides such features as we may make available from time to time. These features may include (without limitation) the ability to:

(a) load E-money into your Digital Money Account;

(b) see the balance of E-money held in that Digital Money Account;

(c) denominate E-money in the different currencies we make available in the Digital Money Account from time to time;

(d) give instructions for E-money to be transferred to another person's Digital Money Account;

(e) redeem E-money and transfer the proceeds either to yourself or to another Payee; and/or

(f) buy Airtime Top Up with the proceeds of E-money and transfer this either to yourself or to another Payee.

The Digital Money Account is held and administered in the United Kingdom.

"E-money" means electronically stored monetary value.

“Instruction” means a Payment Request or a Payment Instruction, as the case may be.

"Local Taxes" means any taxes or charges payable in the Destination Country.

"Money Transfer" means an electronic money transfer using our Services, either within the same country or to another country.

"Payee" means either:

(a) you, where you receive money or E-money from someone else, or where you send the proceeds of E-money or Airtime Top Up to yourself; or

(b) someone else that you send money, E-money or Airtime Top Up to using your Digital Money Account.

"Payment Instrument" includes a payment device such as a debit card, credit card, or Digital Money Account.

"Payment Request" means a specific instruction from you (or a Third Party Provider on your behalf) to a Sender, asking them to send you money, or to send E-money to your Digital Money Account.

"Payout Amount" means the amount paid, after any foreign exchange conversion, to you or to a Payee, exclusive of the Service Fee and/or any other fees, charges or costs we reasonably incur.

"Payment Instruction" means a specific instruction from you (or a Third Party Provider on your behalf), using the Portal, to send:

(a) the proceeds of E-money, or Airtime Top Up, to yourself; or

(b) money, E-money, the proceeds of E-money, or Airtime Top Up, to another Payee.

"Portal" means any app, website, interface or other digital portal we provide from time to time to enable you to use our Services under the Agreement.

"Prohibited" means activities which involve narcotics, steroids, pharmaceuticals, chemicals, drug paraphernalia, tobacco, seeds, plants, animals, military or semi-military goods or services, weapons (including dual-use goods), adult services or content, bitcoin or other cryptocurrency, binary options or gambling services or any other activities that are prohibited by our policies as amended from time to time.

"Sender" means either:

(a) someone who sends us money to hold to your order; or

(b) someone who sends E-money to your Digital Money Account.

"Services" means any or all of the following services:

(a) Money Transfer;

(b) Digital Money Account;

(c) Airtime Top Up.

"Service Fee" means our fee described as such on our Website from time to time. Other taxes (for example, Local Taxes) and costs may exist that are not paid through us or imposed by us.

"Service Provider" means a local bank, money exchange house, or other third party service provider (e.g. mobile network operator) in the Destination Country who we work with to provide services to you.

"Third Party Provider" means any online provider that you authorise to access your Digital Money Account, or to give us a Payment Instruction on your behalf. Depending on the authorisations you give them, Third Party Providers will have access to your Transaction History and will be able to send us Payment Instructions, as if they were you. Many Third Party Providers will be authorised by the UK Financial Conduct Authority, or by the equivalent regulatory body in another country in the European Economic Area (which includes the member states of the European Union plus Iceland, Liechtenstein and Norway). If you are thinking of using a Third Party Provider, then you should ask for details of its authorisation and check these yourself. You should also make sure you are comfortable giving the Third Party Provider the right to give Payment Instructions on your behalf and/or to access your Digital Money Account.

"Transaction" means the transfer of money, E-money or Airtime Top Up using our Services, as the case may be.

"Transaction Amount" means:

(a) the amount of money or E-money that a Sender wishes to send to you;

(b) the amount of the proceeds of E-money, or the value of the Airtime Top Up, that you wish to send to yourself; or

(c) the amount of money, proceeds of E-money, or the value of the Airtime Top Up, that you wish to send to another Payee.

In each case, the Transaction Amount excludes any applicable Service Fee and is the amount displayed by us in the Portal prior to any foreign exchange conversion.

"Transaction History" means the record of your Transactions which are accessible through our Portal.

"Website" means our public website.

3. PROVISION AND USE OF SERVICES

3.1 Subject to the terms of the Agreement, we agree to provide the Services to you using reasonable care.

3.2 You may not be able to use the Services, or some aspects of the Services, if you are located in certain regions, countries, or jurisdictions. This restriction may also apply where you are temporarily accessing our services from those regions, countries or jurisdictions (for example if you are travelling).

3.3 You must not access, use or attempt to use the Portal to provide any Instructions unless you are at least 18 years old. Depending on the country in which you live, local laws may set a different age or impose additional rules on your ability to enter into an agreement with us and to use the Portal. If this is the case, it is your obligation to comply with the local laws which affect you.

3.4 You must not use any device, software or routine to interfere or attempt to interfere with the proper working of the Portal or any Instruction being conducted through the Portal.

3.5 When registering for and using the Portal, you must:

(a) provide us with true, accurate, current and complete evidence of your identity, and promptly update your personal information if and when it changes;

(b) provide us with any identity documentation as may be requested by us;

(c) provide us with details of one or more accounts and/or Payment Instruments; and

(d) provide us with true, accurate, current and complete information as we indicate on our Website is required to use the Portal and any other information which may be required in relation to you, any Sender or any Payee.

3.6 You must take reasonable steps to keep the details you use to access the Portal safe and to prevent their fraudulent use. These steps include:

(a) disguising those details if you write them down and keeping them out of sight of third parties who should not have access to the Portal or (if applicable) your Digital Money Account.

(b) not sharing those details with anyone else, unless they are a Third Party Provider that you have authorised to give Payment Instructions on your behalf and/or to access your Digital Money Account, and they need those details in order to provide these services to you; and

(c) following any reasonable instructions which we give you or publish in our Portal or on our Website from time to time and which are intended to help you keep your use of our Services safe.

3.7 You must only use the Portal to send money, E-money or Airtime Top Up to people that you know personally, and not to pay for goods or services from third parties you do not know and trust. If you choose to pay third parties for goods and services using our Services, please note that we have no control over, and is not responsible for, the quality, safety, legality, or delivery of such goods or services, and that any such use of the Portal and our Services is entirely at your own risk.

3.8 You must only act on your own behalf. You may not submit an Instruction or receive a Transaction on behalf of a third person.

3.9 You must not use the Portal to send Transaction Amounts in connection with illegal activity including but not limited to money-laundering, fraud and the funding of terrorist organisations. If we reasonably believe you are using the Portal or our Services in connection with illegal activity or for any fraudulent purpose, or are permitting a third party to do so, we may report you to the appropriate legal authorities.

3.10 When using the Portal, Digital Money Account or our Website or when interacting with us, with another user or with a third party, you must do the following:

(a) comply with the terms of your Agreement with us as well as any applicable laws, rules or regulations;

(b) provide confirmation of any information you provide to us, including proof of identity;

(c) co-operate in any investigation that we reasonably carry out, or that is carried out by any law enforcement agency, government agency or regulatory authority;

(d) not create more than one registration without our prior written permission;

(e) not provide false, inaccurate, or misleading information;

(f) not use an anonymising proxy (a tool that attempts to make activity untraceable); and

(g) not copy or monitor our Portal or Website using any robot, spider, or other automatic device or manual process, without our prior written permission.

3.11 If you have any problems using the Portal, Digital Money Account or our Website, you should contact us without delay through the channels listed at the end of these Terms and Conditions.

3.12 If you suspect or become aware that the details that you use to access the Portal or your Digital Money Account, or that money in the Digital Money Account, has been lost, stolen, compromised, used without your authorisation, or used fraudulently, you must contact us immediately through the channels listed at the end of these Terms and Conditions.

3.13 Provided it would not be unlawful for us to do so, and it would not compromise reasonable security measures, we will contact you by phone or email if there is an actual or suspected fraud affecting your use of the Portal, any money we hold to your account (including in your Digital Money Account), or a security threat affecting the Portal, your money or your Digital Money Account.

3.14 Nothing in the Agreement or in any other information provided by WorldRemit as part of the services covered by the Agreement is intended to be, nor should it be construed to be, legal or other advice. You must consult your own professional advisers as to the effects of laws which may apply to the Agreement and the services under it.

4. PAYMENT REQUESTS

4.1 You must not submit Payment Requests to people you do not know personally.

4.2 When you submit a Payment Request, you are requesting that we process the Payment Request on your behalf and you are consenting to us contacting the Sender for these purposes. Your Payment Request will be treated as being received by us once you submit it to us using the Portal. When we send a Payment Request by SMS text message to a Sender on your behalf, we may use the mobile telephone number associated with your account for this purpose (i.e. the Payment Request we send will show as being sent from your mobile telephone number).

Cancellation of Payment Requests

4.3 Once we have received your Payment Request, you cannot cancel it. In such circumstances you must contact the Sender separately, and explain that you want the Payment Request to be treated as cancelled.

4.4 If a Sender asks us to cancel a payment to you after they have initiated the payment, you must co-operate with us in order to return the payment to the Sender. This may include you refunding the amount to us or to a third party of our choice (including but not limited to the Sender or their payment service provider). Where a Sender makes a request for a refund which we are obliged to process, we can remove funds from any money we hold to your account (including in your Digital Money Account) which are equal to the amount of the refund.

4.5 If a payment service provider tells us that they have made a payment to us for your account (or into your Digital Money Account) by mistake, we are obliged to co-operate with them and help them recover the mistaken payment. We must provide them with all relevant information they need to collect the payment. If the Sender's payment service provider is unable to recover the funds from us and the Sender asks them to do so, the Sender's payment service provider will provide all relevant information they have to the Sender so that the Sender can claim repayment. This information will include your name and contact address.

4.6 If we ask you to do so, you must without delay refund to us or a third party of our choice any payment you receive using our Services, where we reasonably believe that the payment:

(a) resulted from unauthorised use of the Portal by you or someone else, or use of the Portal by you in contravention of your Agreement with us; or

(b) is connected with illegal, fraudulent or Prohibited activities carried on by you or someone else.

5. MAKING PAYMENTS

5.1 When you give us a Payment Instruction, you are requesting that we process the Transaction on your behalf and you are consenting to the execution of the Transaction. Your Payment Instruction will be treated as received by us once you submit it to us using the Portal.

5.2 It is your responsibility to make sure all the details are accurate before you give us a Payment Instruction. Once we have received a Payment Instruction, it is not normally possible to change any details of that Payment Instruction. You will be given the opportunity to confirm a Payment Instruction before submission and you must check the details carefully.

5.3 The total amount (the Transaction Amount, Service Fee and other applicable fees and charges) that you must pay and the relevant exchange rate selected by us will be displayed clearly in the Portal before you are asked to confirm your Transaction.

5.4 There may be times when we have to convert a payment into or out of your Digital Money Account from one currency into another. This could happen when:

(a) you pay or receive a Transaction Amount in one currency and the Payout Amount is in another currency;

(b) there is a payment to your Digital Money Account in one currency and your Digital Money Account is denominated in another currency;

(c) you change the denomination of the E-money held in your Digital Money Account from one currency into another currency; or

(d) you transfer E-money from your Digital Money Account in one currency and the Payee's Digital Money Account is denominated in another currency.

In each case, there will be a difference between the exchange rate at which we buy foreign currency and the exchange rate provided to you. WorldRemit and its Service Providers usually make a small profit in these circumstances. In the case of a Transaction, we will pay you the Payout Amount we confirm to you in local currency. Likewise, in the case of a payment to your Digital Money Account, we will issue E-money for the amount we confirm to you, in the currency in which your Digital Money Account is denominated. The margin taken on foreign currency exchange covers our risk that exchange rates may change between the time we confirm the Payout Amount (or the amount we will issue in E-money) and the time we make the payment (or issue the E-money).

5.5 If a Payee’s account is denominated in a currency other than the currency you instructed us to make payment in there may be delays, additional charges or different exchange rates.

5.6 We will have no responsibility for any fees or charges you may incur by the use of a particular account or Payment Instrument to fund a Transaction. These may include but are not limited to unauthorised overdraft fees imposed by banks if there are insufficient funds in your bank account, or "cash advance" fees and additional interest which may be imposed by credit card providers if they treat use of our Services as a cash transaction rather than a purchase transaction.

Information we need

5.7 In order for us to process a Payment Instruction correctly, you must give us the following information:

Type of payment | Information we need |

|---|---|

Bank Transfer WorldRemit | Bank Name Branch Name Account Number Bank Code Branch Code IBAN BIC (or SWIFT) Account Type |

Digital Money Account to Digital Money Account Transfer | Payee full name Mobile number of the Payee Country of residence of the Payee |

Cash Pick Up | Payee Full Name |

Mobile Money | Mobile Money Account Number |

Airtime Top Up | Mobile Number of Payee |

Door to Door | Payee Full Name Payee Address |

Bill Pay | Biller Name Biller Account Number |

For payments in some countries, different information may be needed. We will let you know if this is the case.

5.8 In addition to the information set out in the table above, you must give us the following information:

(a) any other information that must be provided for a Payment Instruction to be properly executed, as specified when you enter the details of the Transaction you wish to carry out;

(b) any other information we need to obtain in order to comply with our obligations under relevant laws, rules and regulations; and/or

(c) if you intend to submit an Instruction or receive a Transaction on behalf of a third person, you must first inform us of your desire to do so. You must also provide us with any additional information about that person we request in order that to help us decide whether to accept your instruction or receive a Transaction.

Timing of payments of money

5.9 Subject to the terms of the Agreement, where you make a Money Transfer (or redeem E-money from your Digital Money Account and instruct us to make a payment of the proceeds), the Payee will receive the payment as set out in the table below. In each case, the period of time is calculated from the time we actually receive your Instruction. You should bear in mind that payment may be refused or delayed for the reasons set out in clause 7.1, or we may be unable to process the payment as quickly due to circumstances outside our control (as explained in clause 13.10).

We have grouped different types of payments into three separate groups:

Group 1: where the Payee will receive the payment within one Business Day |

|---|

Payments in pounds sterling (GBP) payment in GBP to an account in the United Kingdom conversion from euro to GBP, followed by a payment in GBP to an account in the United Kingdom only Payments in euro payment in euro to an account in the European Economic Area conversion from GBP to euro, followed by a payment in euro to an account in the European Economic Area |

Group 2: where the Payee will receive the payment within four Business Days |

|---|

Payments to accounts in the European Economic Area not covered by Group 1 payment in a European Economic Area currency to an account in the European Economic Area, where the payment falls outside Group 1 conversion from one European Economic Area currency to another European Economic Area currency followed by payment to an account in the European Economic Area, where the currency conversion and/or payment falls outside Group 1 |

Group 3: please contact us for information about how long the payment will take |

|---|

payment in a non-European Economic Area currency to an account anywhere in the world payment in any currency (including a European Economic Area currency) to an account outside the European Economic Area currency, with or without a currency conversion |

Timing of E-money Payments

5.10 Where you give us an Instruction to pay E-money from one Digital Money Account to another Digital Money Account, we will (subject to the terms set out in the Agreement) make the payment no later than the next Business Day after the day on which we receive the Instruction.

5.11 We may send and receive notifications in relation to Transactions by email and SMS. We will provide you with information after receipt of a Payment Instruction enabling you to identify the Transaction, along with details of the amount of the Transaction in the currency used in the Payment Instruction, our Service Fee, exchange rate and the date on which the Payment Instruction was received. We will provide this information to you no later than 30 days after the date of the relevant Transaction.

5.12 We will attempt to provide you with up to date information regarding the location and opening hours of our Service Providers by means of information in our Portal or on our Website. However, we will not be responsible for any inaccuracies that may appear in that information or any loss which may result from incorrect or incomplete information.

6. CANCELLATION OF INSTRUCTIONS

6.1 Once we have received your Instruction, you cannot cancel it.

6.2 Notwithstanding clause 6.1, we may, in our absolute discretion, attempt to reverse your Instruction if you have informed us that you wish us to do so. In some cases, we may have initiated an irreversible request for funds to be paid out to your Payee by a Service Provider. If this is the case, we cannot guarantee that the reversal will be successful.

6.3 We can apply a charge for attempting to reverse your Instruction.

7. OUR RIGHT TO REFUSE OR DELAY PROCESSING AN INSTRUCTION

7.1 We may refuse any attempted payment to you or into your Digital Money Account, refuse to process any Instruction, or delay processing any such payment or Instruction, at any time for any of the reasons set out below:

(a) we are not satisfied that we have your consent;

(b) we reasonably believe that you, a Sender or Payee are using (or are allowing someone else to use) our Portal, our Website or our Services, in breach of your (or their) Agreement with us or any applicable laws, rules or regulations, or in furtherance of illegal, fraudulent or Prohibited activities;

(c) we have reason to believe that processing any such payment or Instruction would violate anti-money laundering or counter-terrorism financing laws, rules and regulations;

(d) in the case of a payment to us for your account, or to your Digital Money Account, we have reason to believe the security of the account or Payment Instrument used to make the payment has been compromised or we suspect the unauthorised or fraudulent use of that account or Payment Instrument;

(e) we reasonably believe that you are using our Services to purchase goods or services from third parties you do not know or trust;

(f) we are unable to verify your identity, or the identity of the Sender or the Payee (as the case may be). For example, if you have not accessed the Portal, or have not given us instructions in relation to funds held by us to your order or held in your Digital Money Account, for a period of two years then for security reasons we may ask you for additional verification of your identity before we will process your instruction;

(g) you do not provide us with any information we have reasonably requested from you, as explained in clauses 5.7 and 5.8;

(h) we reasonably believe there may be fraudulent activity or other financial crime affecting you, any Sender or Payee, any money we hold to your account, your Digital Money Account, or any payment;

(i) we are obliged to do so by any law, regulation, court order or instruction from an ombudsman, regulator or government body;

(j) there is a dispute (which we reasonably believe is genuine) about who owns, or is entitled to, any money or any E-money held by us to your account, or in your Digital Money Account. This includes (but is not limited to) the situation where a Sender makes a request for a refund of funds the Sender has sent to us for your account or to your Digital Money Account, or we are made aware that the Sender has made a claim against you for return of those funds;

(k) you have broken the terms and conditions of your Agreement with us in a way that we reasonably believe justifies us in refusing or delaying processing any payment or Instruction, and you have not put this right;

(l) we reasonably believe that processing the payment or Instruction would breach the terms and conditions of your Agreement with us;

(m) in the case of a Money Transfer or a payment into or out of the Digital Money Account, the amount of the payment exceeds any transaction limit we may apply to such payments under clause 17.3 from time to time;

(n) in the case of a Money Transfer or a payment out of the Digital Money Account, there are insufficient funds to make the payment and/or to cover our Service Fee and any other fees, costs or charges we may incur in making the payment;

(o) in the case of a Money Transfer or a payment out of the Digital Money Account, the Payee has not yet set up their account to receive payment, or has not registered with us to use our services, or the terms of the Payee's account prevent completion of the Transaction, or the Payee's account is unable to receive payment in the form in which we make payment;

(p) you are subject to an order relating to your bankruptcy, or you have entered into a voluntary agreement with your creditors; or

(q) we have blocked your (or a Third Party Provider's) use of the Portal and/or your Digital Money Account under clause 15.

7.2 We can charge a fee for refusing any payment or Instruction. Where such a fee applies, it will be set out in the Portal or on our Website.

8. FEES AND CHARGES

8.1 For each Payment Instruction you give us, you must pay us the applicable Service Fee (this will be explained in the Portal). Payment becomes due at the time that you submit your Payment Instruction.

8.2 If you submit a Payment Instruction that results in us becoming liable for charges (including but not limited to chargeback or other fees which we are obliged to pay), you must reimburse us for all such fees.

8.3 A surcharge may apply for processing credit cards in certain jurisdictions. The amount of the surcharge will be notified to you at the time of the card payment.

9. USE OF THE DIGITAL MONEY ACCOUNT

9.1 A Digital Money Account is set up by either (a) registering for WorldRemit within the Portal or (b) logging into the Portal after registering on the Website and then taking the additional step of verifying your phone number (or other additional steps as we may later deem necessary).

9.2 Where this service is available in your country, you can load E-money on to your Digital Money Account using the Portal, or by using such other methods as we may make available from time to time.

9.3 Where a Sender has sent E-money to your Digital Money Account, or money to be coverted into E-money and credited to your Digital Money Account, the E-money will be credited as follows:

(a) if you have a Digital Money Account, the E-money will be credited to your Digital Money Account once the Transaction has been processed. An SMS will be sent to the mobile number we hold on record for you, informing you that E-money has been credited to the your Digital Money Account; or

(b) if you do not have a Digital Money Account, the money or E-money will be held either by us or to your order and an SMS will be sent to your mobile, informing you to set up a Digital Money Account. If you do not do so within 14 days of our SMS, the money or E-money will be returned to the Sender (after we deduct our Service Fee for returning it).

9.4 You are able to denominate E-money held in your Digital Money Account in the different currencies we make available in the Digital Money Account from time to time.

9.5 E-money held in the Digital Money Account will not earn any interest.

9.6 You can use E-money stored in the Digital Money Account by giving us a Payment Instruction, or by using such other methods as we may make available from time to time.

9.7 We may from time to time specify in our Portal or on our Website:

(a) the minimum amount of E-money that can be paid to a Digital Money Account at any one time;

(b) the maximum amount of E-money that can be paid to a Digital Money Account at any one time; and/or

(c) the maximum amount of E-money that can be held in a Digital Money Account at any time.

9.8 E-money that we describe as being "held" in a Digital Money Account is a record of the balance of cash-equivalent value that you are entitled to receive from us. It does not represent a loan arrangement or any other form of credit. It is also not a deposit. This means it is not protected under any deposit protection scheme in the United Kingdom or that may exist in your country. Instead, we hold and manage E-money in the United Kingdom in accordance with the laws, rules and regulations applicable to authorised electronic money issuers in the United Kingdom.

9.9 You cannot transfer the Digital Money Account, or any of your rights in a Digital Money Account, to any other person. You cannot grant any charge or other security over E-money held in a Digital Money Account.

Your right to redeem E-money from your Digital Money Account

9.10 You have the right at any time while your Agreement with us is in effect to redeem all or part of the E-money in your Digital Money Account. You also have the right to redeem E-money for a period of six years after termination (or cancellation) of the Agreement. However, if you redeem E-money upon or after termination (or cancellation) of the Agreement, you must redeem all the E-money you hold.

9.11 You can redeem E-money while this Agreement is in place by giving us a Payment Instruction. If you redeem E-money after termination or cancellation of this Agreement, we will, unless you instruct us to make payment in another way that we reasonably agree, pay this as follows:

(a) to a bank account we hold on record for you; or

(b) by crediting it to a Mobile Money account we hold on record for you.